does indiana have a inheritance tax

Indiana Inheritance and Gift Tax. Indiana repealed the inheritance tax in 2013.

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Indiana inheritance tax is imposed on the transfer of property from an indiana decedent to a.

. How Much Is Inheritance Tax. There is no inheritance tax in Indiana either. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state inheritance.

In general estates or beneficiaries of. Although some indiana residents will have to pay federal estate taxes indiana does not have its own inheritance or estate taxes. Indianas inheritance tax still applies.

You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31. For individuals dying before January 1 2013. Indiana inheritance tax was eliminated as of January 1 2013.

Indiana repealed the inheritance tax in 2013. Inheritance tax was repealed for individuals dying after Dec. There is no inheritance tax in Indiana either.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Does Indiana Have Estate Or Inheritance Tax. State inheritance tax rates range from 1 up to 16.

Indiana inheritance tax was eliminated as of January 1 2013. An inheritance tax would be applied on transfers to each person who is receiving an inheritance but some relationships can be exempt. However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or.

On the federal level there is no inheritance. On the federal level there is no inheritance tax. You do not need to pay inheritance tax if you received items from an indiana resident who died after december 31 2012.

If you have any questions concerning the repeal of. The federal government has a gift tax though with a yearly exemption of 15000 per recipient. The federal government has a gift tax though with a yearly exemption of 15000 per recipient.

However other states inheritance laws may apply to you if someone living in a state with an. How much tax will you pay in indiana on 60000. Indiana does not have an inheritance tax nor does it have a gift tax.

In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption. There is no inheritance tax in Indiana either. Indiana does not levy a gift tax.

As a result Indiana residents will not owe any Indiana state tax after this date with. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Are required to file an inheritance tax return.

There is no inheritance tax in Indiana either. Indiana does not levy a gift tax.

Indiana Repeals Inheritance Tax Kahn Dees Donovan Kahn Llp

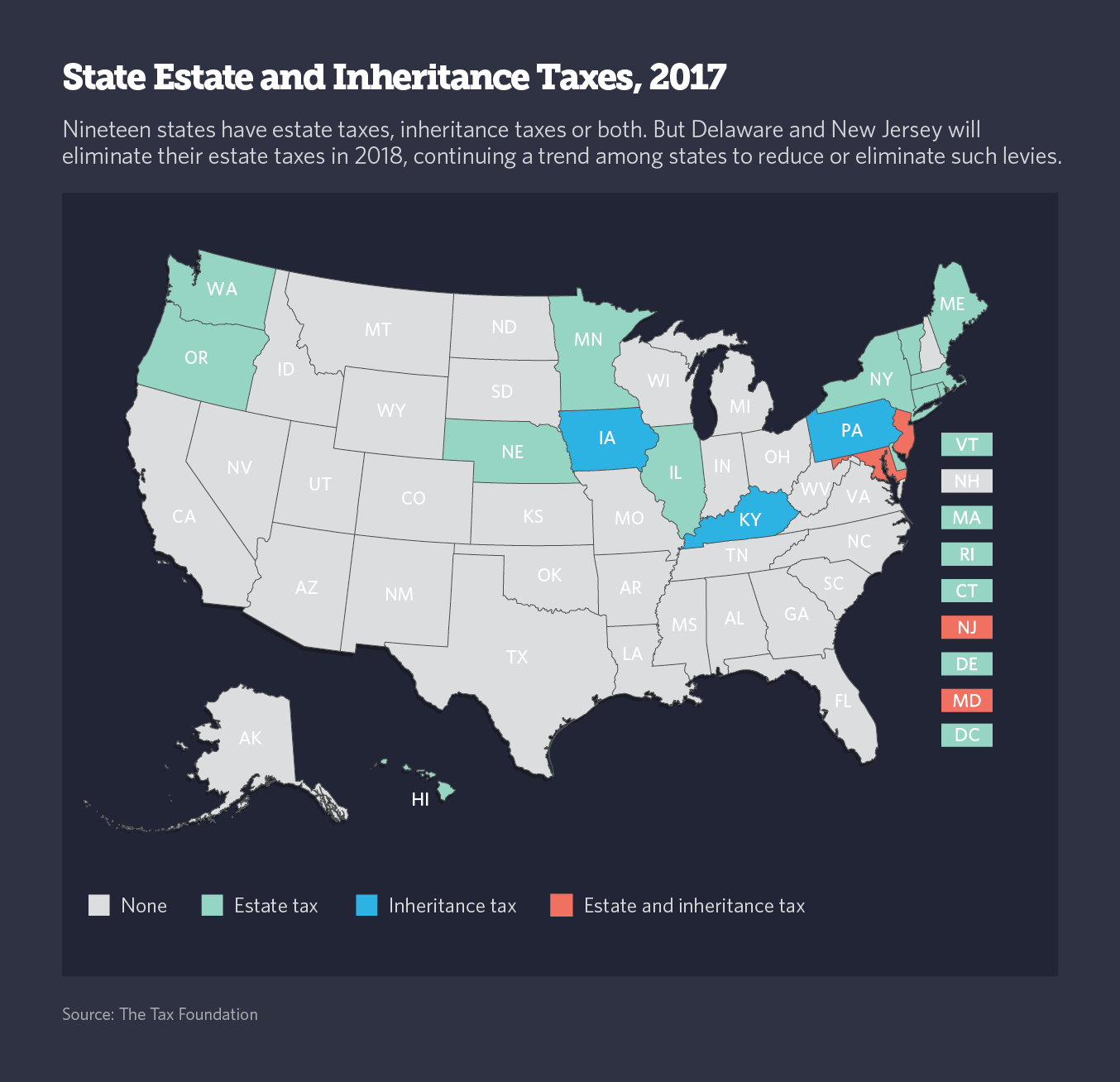

States With No Estate Tax Or Inheritance Tax Plan Where You Die

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

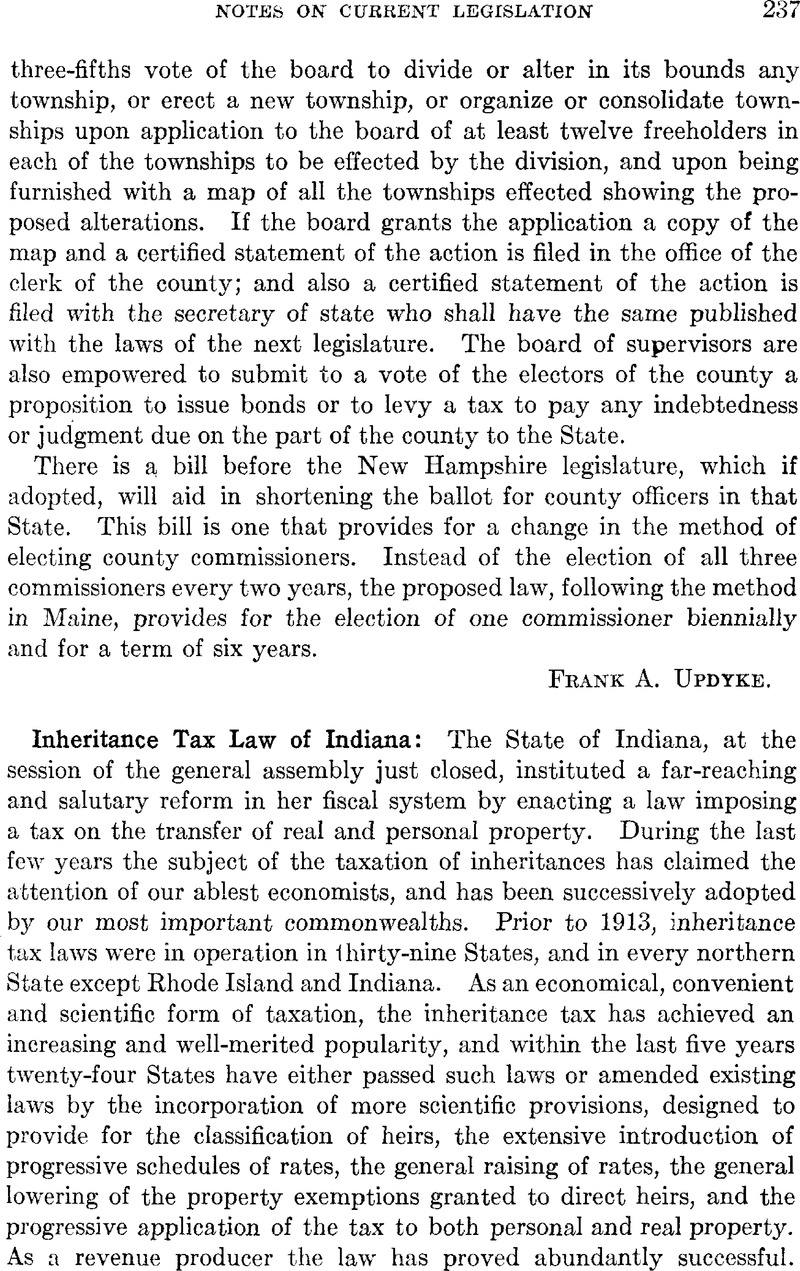

Inheritance Tax Law Of Indiana American Political Science Review Cambridge Core

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Estate And Inheritance Taxes Itep

Indiana Department Of Revenue Inheritance Tax Section Indianapolis Bar Association Estate Planning And Administration Section March 28 2012 Don Hopper Ppt Download

Estate And Inheritance Taxes Urban Institute

Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On

Kentucky Estate Tax Everything You Need To Know Smartasset

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Calculating Inheritance Tax Laws Com

State Death Tax Hikes Loom Where Not To Die In 2021

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal